Bromcom Finance: How do I process Non-Invoiced Income

You have two options on how you record Non-Invoiced income as follows:

Navigate to Modules > Finance > Accounts Receivable

(Note: you will need to setup a receipt book and paying in book if not already done so for accounts receivable via Modules> Finance> Maintenance > Books)

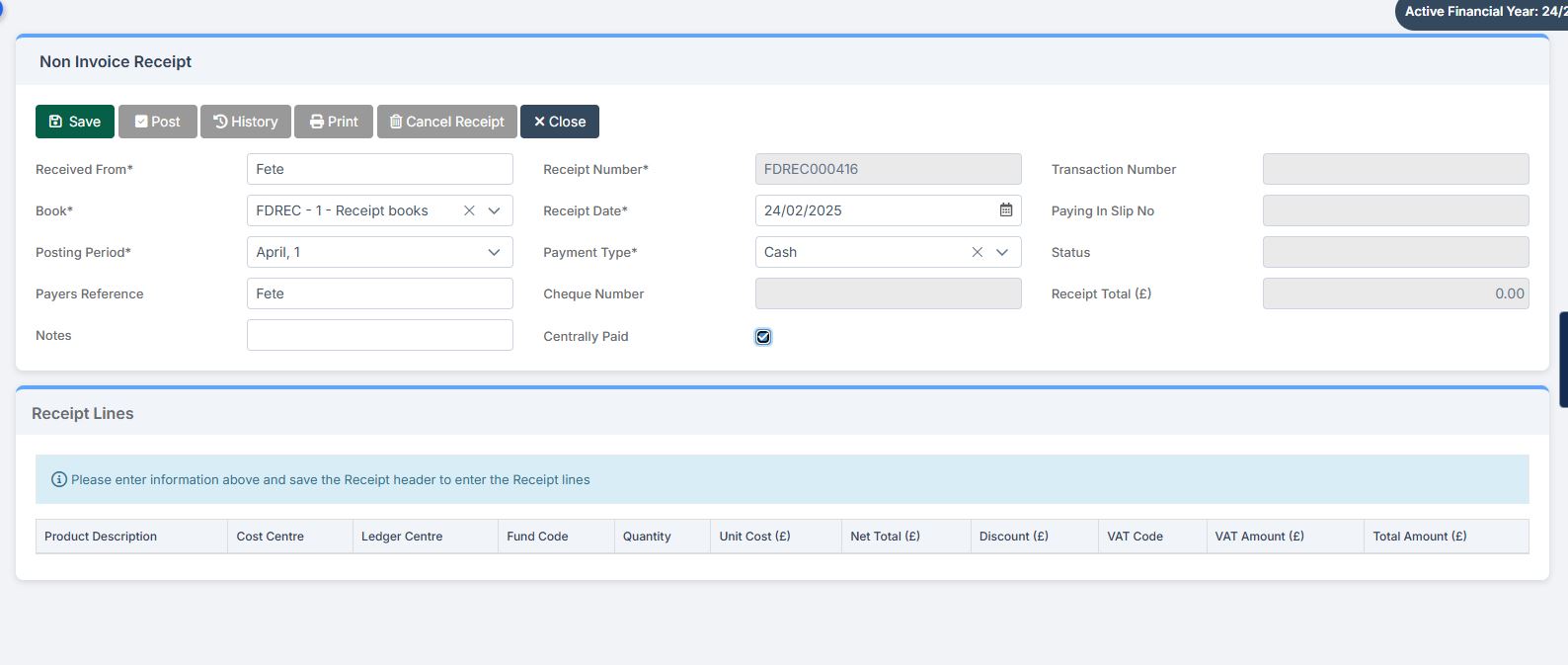

- To record a receipt, click the “non-inv receipt” button, please complete all fields ensuring you select cash or cheque only and tick centrally paid check box and click save.

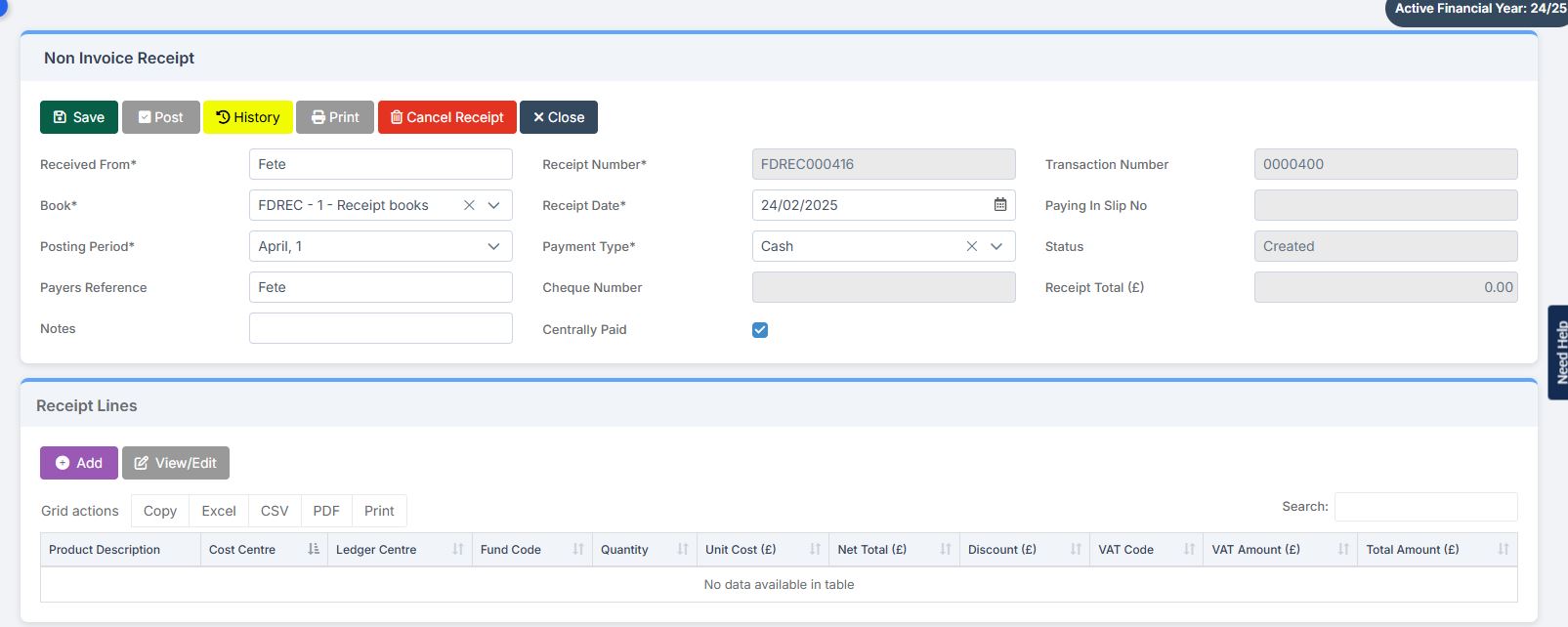

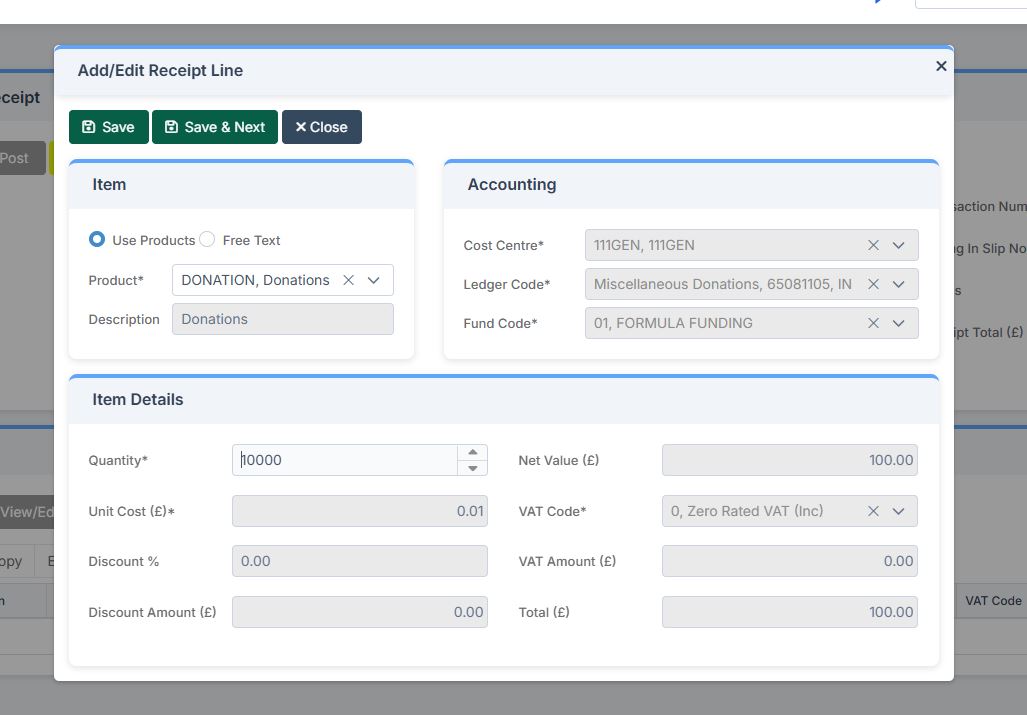

2) Add your receipt lines as in example screen shots below

3) Once you have added your receipt details, please click save & print or save & next.

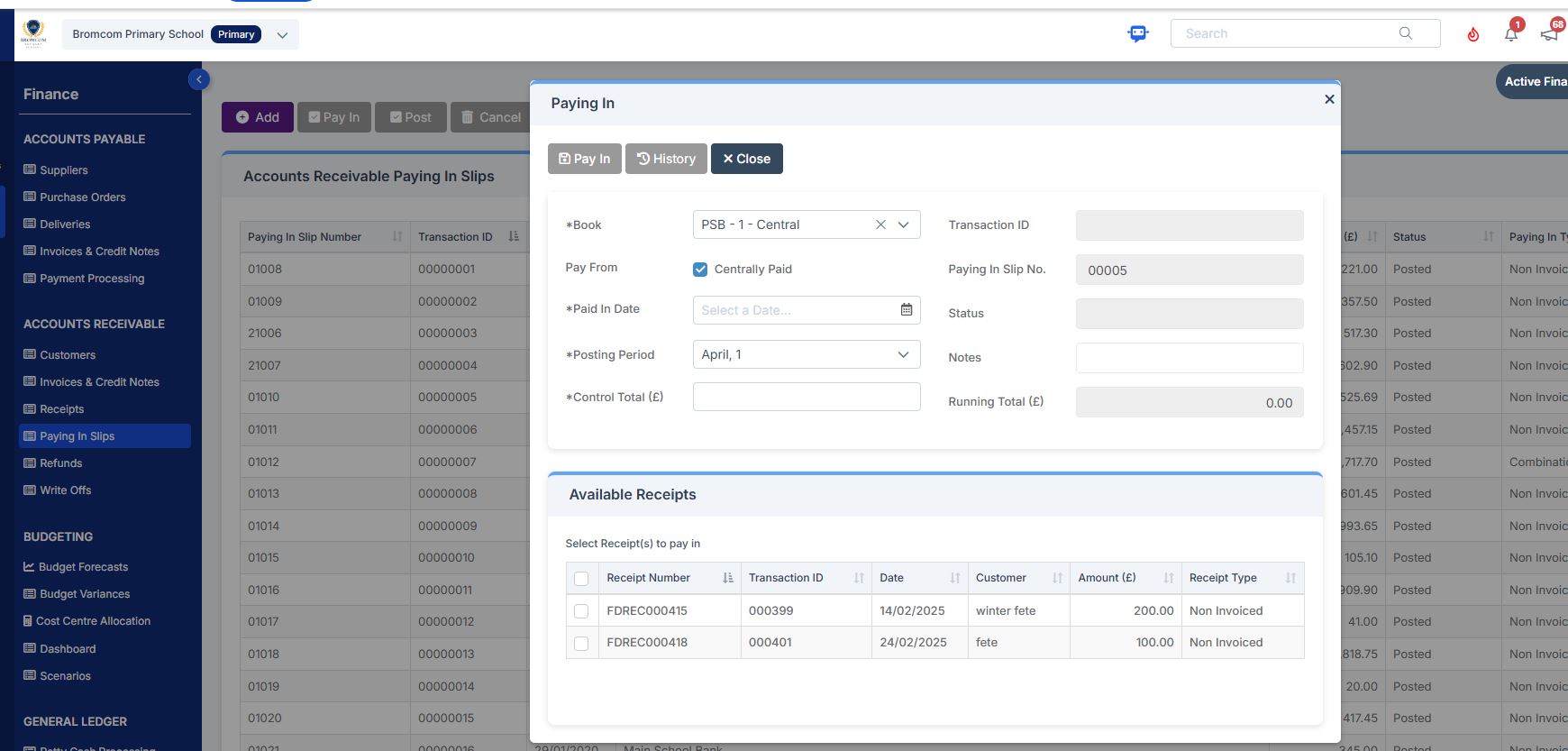

4) Please Click the purple add button to add a paying in slip, select the book, pay from, paid in date, posting period and tick centrally paid.

5) Tick the receipt lines applicable and click pay in and say yes to authorise and print

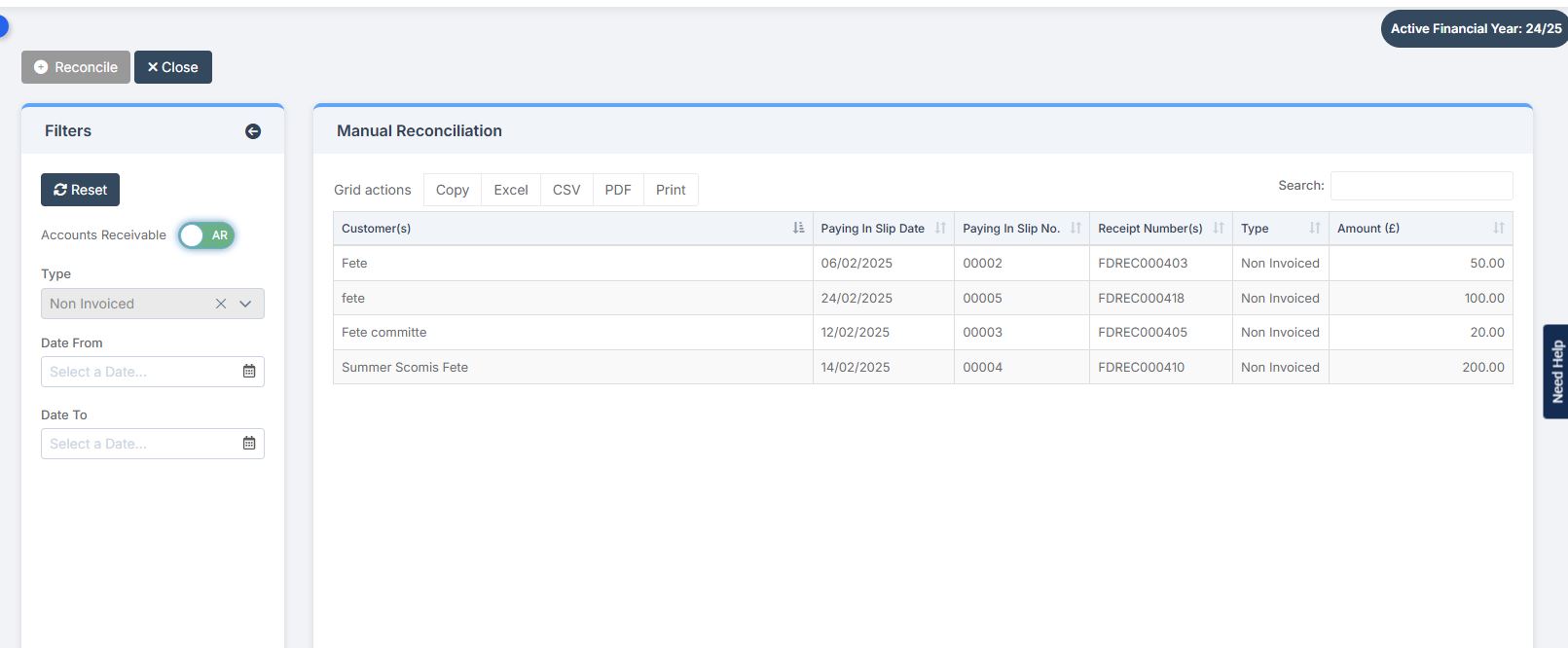

6) Now that you have recorded the receipt and paying in slip you will need to navigate to Modules> Finance > General ledger> Central Manual reconciliation> switch toggle button from Accounts Payable to Accounts receivable as in this screen shot below and manually reconcile the relevant income recorded in the above steps.

7) When your automatic reconciliation comes down, you will need to delete the line as you will have already reconciled in step 6

For more information on recording non-invoiced income , please see Non Invoiced income receipt guide

The alternative option is you could record via Accounts payable

The other option is you can record in accounts payable via Modules> Finance> Routines> Central payment and receipt

- Import file and identify income

- Record a Central Receipt for the Money received Modules Finance> Central payment and receipts

- Delete item from auto rec