How to carry out a Contra / Cancel Payment within FMS

In some instances it is necessary to cancel a payment within FMS, also known as contra payment. Please see the below scenarios of how to deal with cancelling a payment within FMS.

Scenario 1 – Invoice status- Authorised

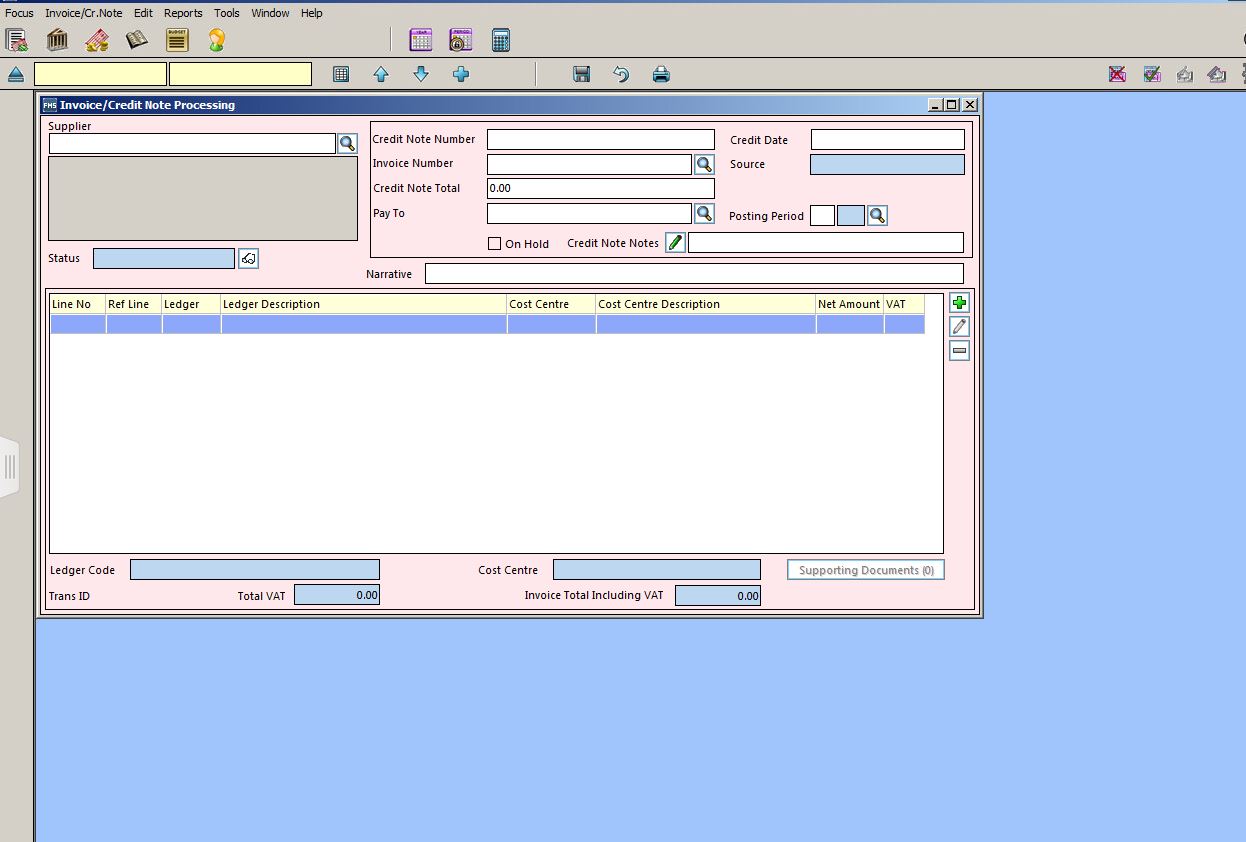

If you have processed an invoice and have marked the invoice as “Authorised”, you can cancel the invoice by highlighting the invoice and click on the Cancel/Invoice credit Note in the top right corner of the invoice /credit note processing screen.

![]()

Scenario 2 – Invoice passed for payment, exported from FMS, but not yet authorised in ‘Prepare Authorise Payments’.

If you have processed the invoice, passed it for payment and exported it from FMS but not authorised in ‘Prepare Authorise Payments’, the following steps need to be taken to cancel the payment in FMS

Process a credit note against the invoice, this will then cancel out the invoice payment and return the money to the cost centre.

Instructions for processing a credit note

Focus>Accounts Payable> Invoice/Credit Note, click the blue plus button (Add Record) Select “Credit Note” complete the credit note and post (Tip) – It’s useful to select the same period as you raised the invoice as you will then be able to check in “chart of accounts” via Focus>General Ledger> “Chart of accounts review” to see that the payment has been returned.

Important: Please continue to upload the invoice along with the credit note as this will cancel out the payment you wish to cancel.

Both the invoice and credit note will need to be manually reconciled to complete the process via Focus> Central> Manual reconciliation

Scenario 3 – When invoice has been passed for payment and uploaded, but has been ‘rejected’ for payment (This could be that it has the wrong LA reference number or any other reason)

The following steps should be taken within FMS:

Focus>Central>Manual Reconciliation – reconcile the item as it will not be returned by Payments via the automatic reconciliation route.

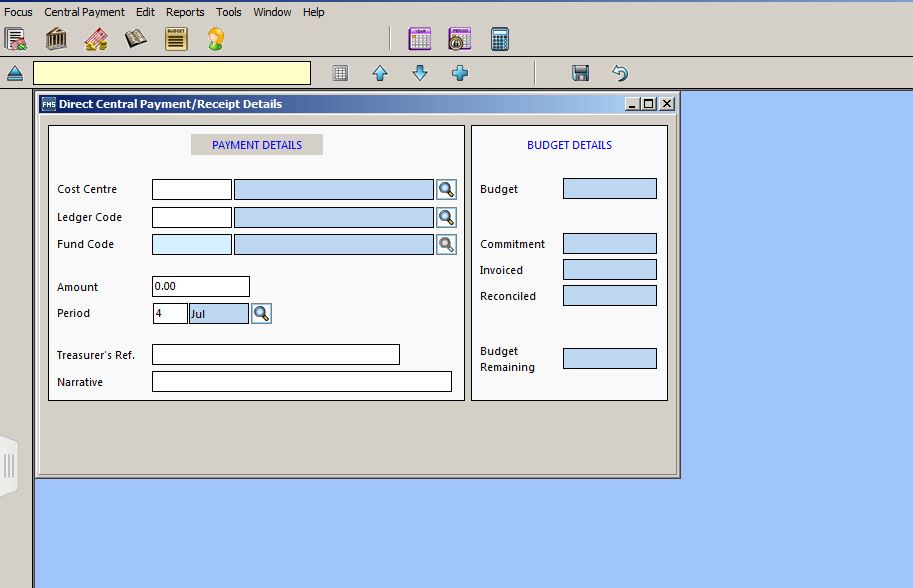

Focus> central> Payment, click the blue plus button and select Payment, or receipt if income (Important) you will need to record the amount with a – figure as this will credit the cost centre back with the funds originally paid out.

If the invoice had an incorrect LA reference, you will need to correct this before raising a new invoice. To correct the lea reference, take the following route:

Focus> Accounts payable> supplier

Double click the required supplier, click tab 2 – Additional – Click the spy glass next to Payment to, to add the LA Reference and click save on the blue disk button.

Once you have rectified the error, you can then process the invoice again.

kb17615

Last reviewed 29/7/20