Dealing with Internal Invoices/Payments via Central payments in FMS

Reconciliation items for income may be received into FMS Automatic Reconciliation on a ledger code that you do not wish to use. If this is the case do not process the reconciliation item as normal, instead carry out a central payment into FMS to record the income against the correct ledger code as follows:

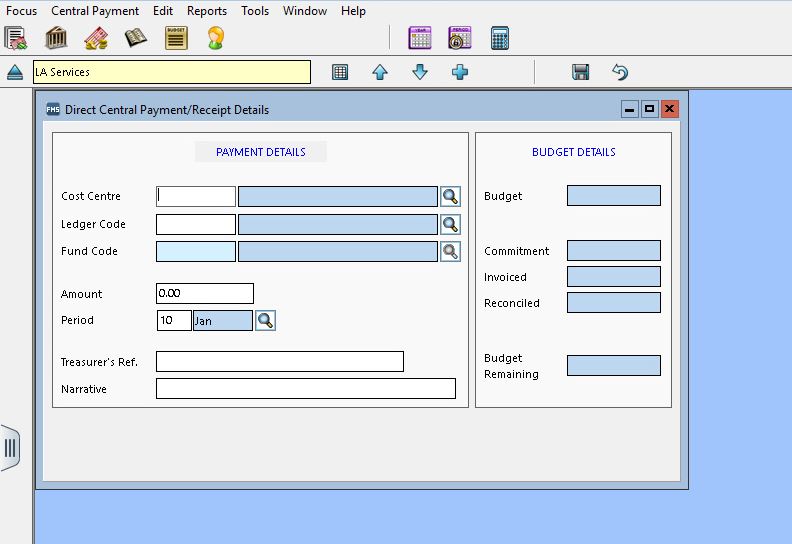

Focus> Central> Payment> Click blue + button and select payment.

Select the Cost centre, ledger code, fund code, amount & period you wish to assign the income amount into and then finally enter a suitable “Treasurer’s ref and Narrative”

NOTE: When crediting a cost centre/ledger code the amount of money entrered must have a minus symbol – in front of the figures E.G -100.00

Once you have entered all the details, click save, you will then be presented with the below message

Click yes, this will then post your income to the desired cost centre and ledger code chosen.

Important: Please don’t forget to that any changes made in FMS, also need to be made by completing an online journal transfer, which will ensure that DCC match what you have recorded in FMS. Once you have received their confirmation you may delete the suspense item from automatic reconciliation in FMS.