How to adjust a posted petty cash claim – central payment school

It is sometimes necessary to adjust a petty cash claim which is already posted, for instance when an incorrect VAT code has been used or if the amount has been mistyped. This is possible but care must be taken not to cancel the whole claim in error.

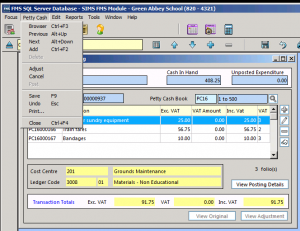

Go to Focus>General Ledger>Petty Cash and open the required claim – the Add/Edit/Delete buttons on the right will be greyed out

Use the dropdown menu Petty Cash>Adjust or the icon on the right to Adjust Transaction (do not choose the Cancel icon) this will activate the Edit and Delete buttons on the right

Make the edit as required, click Save and enter a relevant narrative, click Post

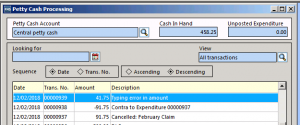

Three transactions will show – the original as Cancelled, a Contra for the same amount of money and finally the new adjusted amount

There is nothing more to do at this point as the original was posted and presumably claimed for. When making the next claim it should be entered and posted as usual into FMS. If the school uses Local Authority software to create a file for uploading the information to the LA then the amended reduction will show on that next claim – ie the first claim totalled too much, the second too little, the net effect being the correct amount overall.

kb20230